We were recently listening to a podcast about what it means to be a change-maker—someone who takes creative action to solve a social problem. In the podcast, the guest, Arlie Hochschild, began discussing the importance of emotional intelligence amongst those who wish to be changemakers, and she brought up an interesting dilemma: the fact that we often associate the financial world with being ‘rational’ and if we inject emotion into that world, it’s perceived as weak. But what if we acknowledged that emotion was basic and foundational to the way we lived our lives—socially, politically, and yes, even financially? What if there was a way to intertwine and join the rational and the emotional in a way that promoted positive change?

Photo by Sarah Dorweiler

It was around the same time that we were introduced to Yova, an ethical investment firm which stands for “Your Values” based here in Switzerland. We listened to one of the founders, Dr. Tillmann Lang, being interviewed and he mentioned his desire to be a change-maker by using specific technology within the financial market. As he continued to speak, we couldn’t help but realize that his entire premise was to inject emotion and empathy and values into a system that has been built looking the other way. We paused the interview and wondered if it was a sign from the universe; we’ve always tried to make a point to live intentionally, sustainably, and ethically—but the more we thought about it, the more we realized that as intentional as we are about where we spend our money, the money we have sitting in a bank can be used for things that are in direct opposition to our values. Or, as Dr. Lang put it in the interview, he didn’t want to spend his days fighting climate change and then spend his nights fueling oil rigs with his money as he sleeps.

“I don’t want to spend my days fighting climate change and then spend my nights fueling oil rigs with my money as I sleep.”

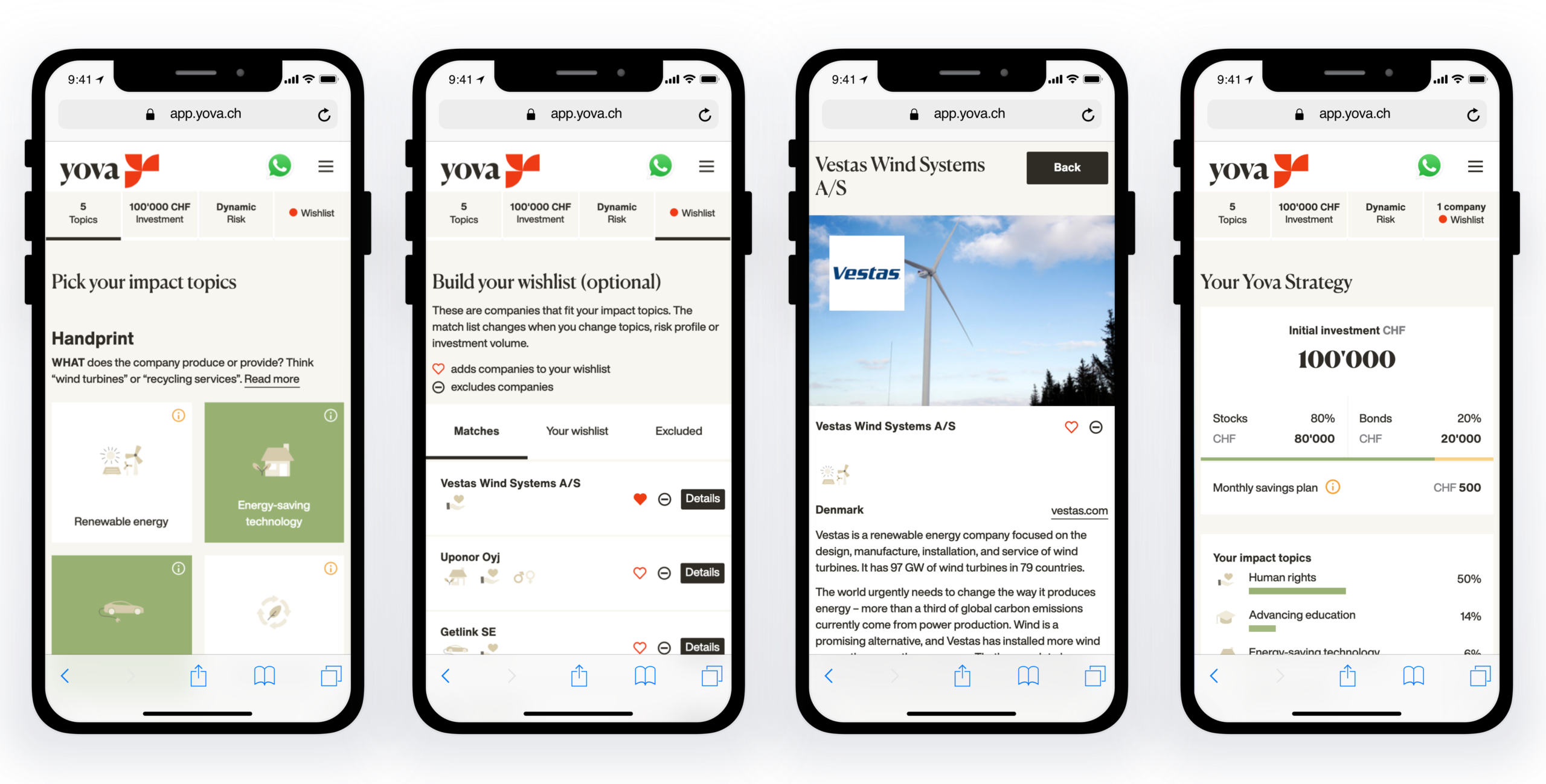

So, what is Yova and how is it different from other investment companies? Firstly, we need to be clear here: we are not investment experts. In fact, the minute you begin talking about finance, the future, shareholders, acquisitions, trades, bonds, and hedge funds our eyes will glaze over and you’ll have realized that you actually lost us when you said the word ‘finance.’ It’s not that we don’t care about it—it’s that we don’t always feel we have the capacity to know enough about it to make informed decisions. This is where Yova feels like a breath of fresh air.

Here are some of the perks of Yova:

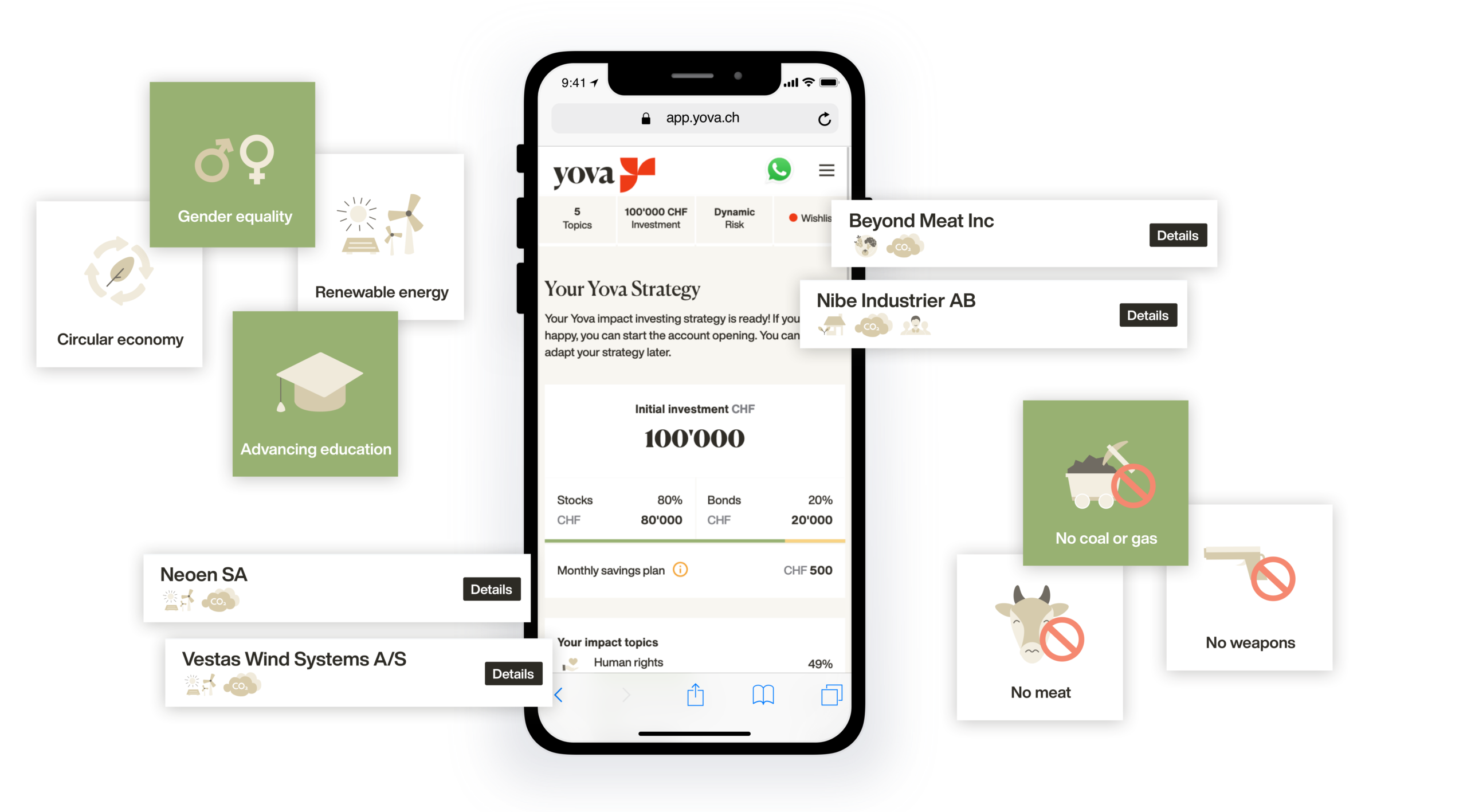

- The best of both worlds. Yova, put simply, is a platform for clients to invest in line with their values. Whether it’s climate change or eating vegan or human rights or biodiversity, Yova allows you to invest directly into companies that promote the type of future you want. And one cool feature is the fact that their platform engine does it in real time; you see a portfolio of companies that promote the things you want for the future, then at the same time Yova applies portfolio theory to ensure it’s a sound investment. You get the duality of having a sustainable impact while receiving a financial return. Emotional meets rational.

- Complete transparency. Yova doesn’t work with funds as many other firms do. What does this mean? It means you become a shareholder directly with these companies that are in line with your values and you always know where your money is, what it does, and what kind of impact it can have. With a fund you don’t necessarily have any control or transparency.

- Control & oversight. Yova uses separately managed accounts. This means Yova opens an account for you in your name and you can access and follow your stocks in your own account. Don’t worry—they still do all the heavy lifting and execute/monitor your investment strategy.

- No hidden fees. Yova charges a management fee of 0.6-1.2%. There is no transaction or product cost. You can even withdraw your money without any fees! We also know what some of you are thinking: investment banking is for the rich. With Yova you can invest anywhere from 2,000 chf to 2 million (obviously we fall at the beginning of that spectrum *ahem*).

We have to say, the more we investigated Yova, the more we were convinced that there is a way to take back control in a world where we feel like so much of it is outside of our grasp. We would love to fall asleep at night knowing that our decisions we make during the day are mirrored with the ones that are made in our sleep. That our money can do more; we can be socially and sustainably proactive and responsible while at the same time making a financial return.

“Taking responsibility sometimes means cleaning up messes that others created.”

We un-paused the interview with Dr. Lang, and heard him continue to speak of the driving forces of his decisions and the grounding principles of Yova. He spoke about the problems we face as a global society; glaciers melting, oceans acidizing, species becoming extinct and people being forced out of their homeland. And then he said something that has stuck with us: “Taking responsibility sometimes means cleaning up messes that others created.” We each have access to our own individual toolkits; resources to ensure that we can do a part, however small, to guarantee that we contribute to change. Because being a change-maker doesn’t mean we need to work at an NGO or create some sort of impact startup—it means we need to “incorporate a sense of responsibility in every action and decision we make.”

Perhaps Yova would be a good place to start.